Apparel retailers are facing another period of uncertainty so protecting profits will be critical. Fixing the quality and depth of data at the top of the funnel will deliver outsized impacts on the profitability for retailers.

Whether it is to make quicker business decisions, improve the customer experience, deliver operational efficiencies or reduce return rates, once the right data is in place there are some very simple things that brands and retailers can do today to drive up to 6% growth in their profit within the next 12 months. That is a significant cash injection for any business.

Data, Data Everywhere But Sadly Not The Right Data

Apparel and fashion industry experts, pundits and the brands themselves have all been extolling just how important data is to the new digital retailing age. No one disagrees; it will be what defines the winners and the losers.

Retailers often cite a lack of resources to process and make the most of the copious amounts of data they have. For fashion retailers, there is a more fundamental problem, they often do not start with the right data.

Let’s look at the facts. To really deliver, apparel retailers need excellent data on both their customers (demand) and their products (supply).

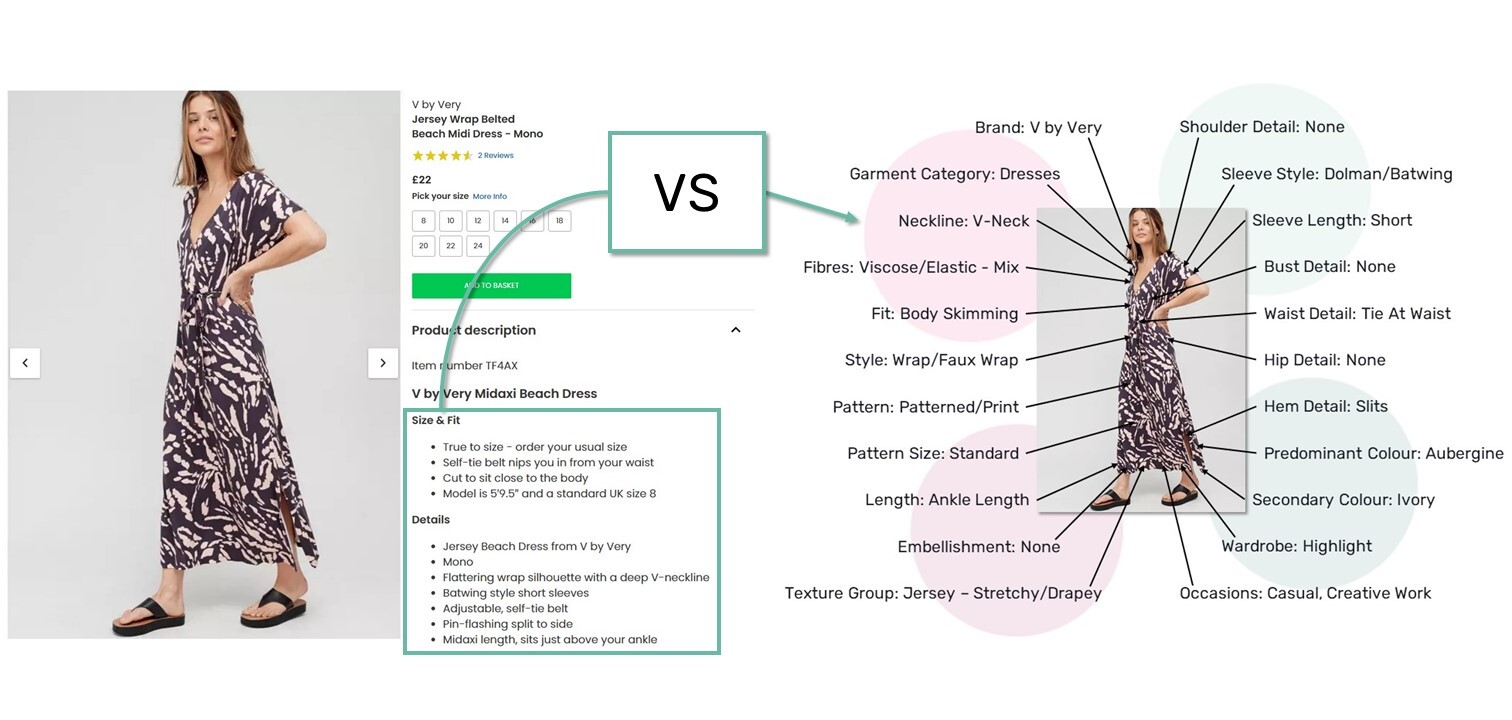

Product Data: This is where it all starts. This is what the customer cares most about. This is why they arrive at the store or on the site in the first place. And yet, it is here, at the top of the funnel where retailers are really missing a trick. Good quality, detailed product data just does not exist. It is not valued as it should be and is typically added by junior merchandisers and buyers who do not necessarily understand the importance of data integrity (with any algorithmic retailing the old adage of rubbish-in rubbish-out is particularly pertinent).

Customer Data: The average customer is buying 40-50 items of clothing a year but for most retailers 70% of those customers are only buying once a year. It is only 5-10% of their customer base, where people really love the brand and are buying multiple items a year, where the retailer has lots of data on the individual customer. For the majority of customers data is sparse and limited to 1 or 2 items a year. What can you really glean from that? One of the best things you can do is learn how to understand every customer’s intent as quickly as possible and then match the supply to the demand.

Once the right quality of data is in place and the true relationship between the products and the customers is understood, retailers will be able to make the right decisions quickly, improve product discovery and deliver more efficient operation processes.

Current State of Apparel Retail

Having survived COVID, one of the biggest shocks to the fashion and apparel industry, many retailers have emerged stronger and have been enjoying the rebound, posting record Q4 earnings (Inditex, Adidas) as customers get back into the swing of things.

But, there is a sense of unease as the industry is set to face another period of volatility. Additional costs due to supply chain issues, higher oil prices and increasing staff costs will continue. We also expect the cost of living crisis to really hit home in 3-6 months’ time.

Given all the uncertainty and external factors, it is impossible to predict what is likely to happen. But the next 12 months could see profits for fashion retailers squeezed by 5-6%+. This could be catastrophic for retailers already operating on low profit and relying on an undisrupted supply chain.

Factors Impacting Profitability

There will always be external shocks (like the current war in Ukraine or the Oil price spikes) that are completely outside of a retailer’s control.

Retailers can impact other costs, for example either by negotiating with and diversifying their supplier base or building better systems and automation into the warehousing operations to combat increasing labour costs.

And then there are factors where retailers have complete control. In these cases, a better use of the right data can have an outsized impact on growing sales and profit. The obvious ones are around assortment planning, size curve forecasts and garment return rates but it is also true of delivering the best possible product discovery process to combat the impact of high inflation on a discretionary purchase like fashion and apparel.

How To Improve Profitability With Better Quality Data Used In The Right Way

1) Size Management Efficiencies: +3% improvement in profitability

Size fragmentation can really eat into profits. Better quality product data and a better understanding of true customer propensities to buy (and keep) features at a size level allows retailers to build significantly better prediction models that clearly show the over and under buy at every size for every product.

When considering how much of each size to stock, retailers typically consider style and length. When analyzing a deeper, better set of data retailers would see that neckline, embellishment and even color play a major part. This cream pair of leather trousers had 8% more sales in sizes 6 & 8 than the equivalent pair in black.

Merchants are often having to make the buy within a 24-48 hour period and they simply don’t have the manpower to sift through reams and reams of data. Fortunately, using better predictive retailing models can deliver significant improvements on increasing full-priced sell-through rates and decreasing markdowns. When you model the true demand for a product (where the optimal outcome is for all sizes to sell through at full price at the same time) you can see that 25% of markdowns could be eliminated.

Retailers that Dressipi works with typically see an average of 3% improvements in their profitability. This use of data-driven retailing models will also often highlight any net “overproduction”, i.e. when retailers are effectively buying markdowns from the outset. This can be easily eliminated with the added side benefit of improving the sustainability of the retailer and reducing waste. Another genuine ESG benefit for everyone.

2) Return rates: 1.5% improvement in profitability

We have written a lot about return rates, it is one of the key inputs into our algorithms and we have made it our business to understand what is driving return rates for retailers. Garment return rates are a major source of revenue and profit leakage for retailers.

Once a retailer understands the relationship between the product attributes and the customer it is much easier to predict a customer’s likelihood of returning an item. By building the return rate propensities into our algorithms we have been able to reduce the return rates for our partners by 10-15% which is 2-3% points. For a womenswear specialty retailer that is a minimum of 1.5% increase in profitability. There is then the added benefit of minimising the reverse logistics hassle with the bonus of a genuine ESG benefit from less emissions and less waste.

3) Product Discovery: 1% improvement in profitability (8% growth in sales)

Unlike pretty much every other category (books, films, health and wellbeing), apparel and fashion retailers still have an undifferentiated experience. Retailers are still, mostly, showing the same products in the same order to all customers regardless of who they are or how frequently they shop.

There are some valid reasons for this. Building good recommendations in fashion is hard and there are some very specific and complex problems to overcome. It is much more important to understand the customer’s real intent as quickly as possible.

As inflation really starts to kick in, it will be even more important to help customers find what they are looking for as quickly as possible. If they have taken the time to come to interact with your brand, they are there because they are interested in buying something. Help them find their items as quickly as possible.

Regardless of where a customer lands, whether it is the PDP (from social channels or Google shopping), the PLP or in your store. They are looking for an experience that is relevant and personalized to them. A more considered and fashion-specific approach will enable this.

Whether it is for the 20-30% of customers driving 70% of revenue or for new customers, this approach means that retailers can offer each customer a journey that is unique to them but in line with the brand DNA that is so key in the fashion domain.

Our AB tests have proven this, consistently outperforming all other providers. Dressipi’s API’s typically deliver up to 8% sales growth within the first 12 months with the added benefit of additional profit due to higher full-priced sell-through rates on top of the lower return rates previously mentioned.

Driving Profitability With Better Data

Practical Steps An Apparel Retailer Can Take

1) Understand the importance of data integrity

2) Build clean, consistent data sets you can cross reference to really understand your business

3) Build as much data on your products as you do on your customers

4) Ensure that data is fully integrated across the business

5) Build infrastructure that really allows you to test and learn

6) Take the time to state the problem and then solve the problem that actually exists

In short, there is plenty a retailer can be doing today to protect their margins for the coming 12-24 months but it is essential they get started right away. This is also profit protection that can be delivered relatively easily without having to compromise on quality or ethical standards.

You might also be interested in this article…

Best examples of AI in fashion retail

Check out the best examples and applications of AI in fashion. Get inspired by how AI is transforming retail shopping experiences.